RICHMOND, Va. -- Elizabeth Sexton, the owner of barbecue restaurant Smohk in Scott's Addition, was one of many Richmond business owners who got caught in a meals tax mess. But Sexton considered the circumstances surrounding her issues to be extreme.

She said the city forced her to sign a Confession of Judgement before accepting her payment for meals tax late fees that she believed she shouldn't even have had to pay in the first place.

Like many other restaurant owners, Sexton submitted a late meals tax payment in the beginning of the pandemic when the city offered a covid-19 amnesty program to help struggling businesses.

“We held back our payment in March of 2020, paid it a little bit later thinking that’s what we were supposed to do according to Mayor Stoney’s offer. Didn't think anything about it, resumed my payments as normal, went on with my life," Sexton said.

But more than two years later, in 2022, Sexton received a letter from the finance department.

Turns out, the city still considered her payment to be delinquent, charged her penalties and interest month after month without notifying her, and allowed late fees to snowball into more than $5,000.

“To me, it’s not about the money. It's about the system that is so broken, that it has come to this? Years later, you're getting these bills that you don't know what they're even for," Sexton said.

Sexton said she tried to dispute the balance but was unsuccessful.

In November 2022, she received another letter in which the city said it may take legal action against her if she didn't pay the balance, including lawsuits, seizure of property, or liens against income tax refunds or wages.

In December 2022, she gave in and decided to pay.

“When I went down to City Hall with a checkbook in hand ready to pay up, they put in front of me a legal form that I had to sign admitting that I had willingly and voluntarily not paid my meals tax, which I paid every penny of, and they wouldn't accept my check until I'd signed this pseudo legal document," Sexton said.

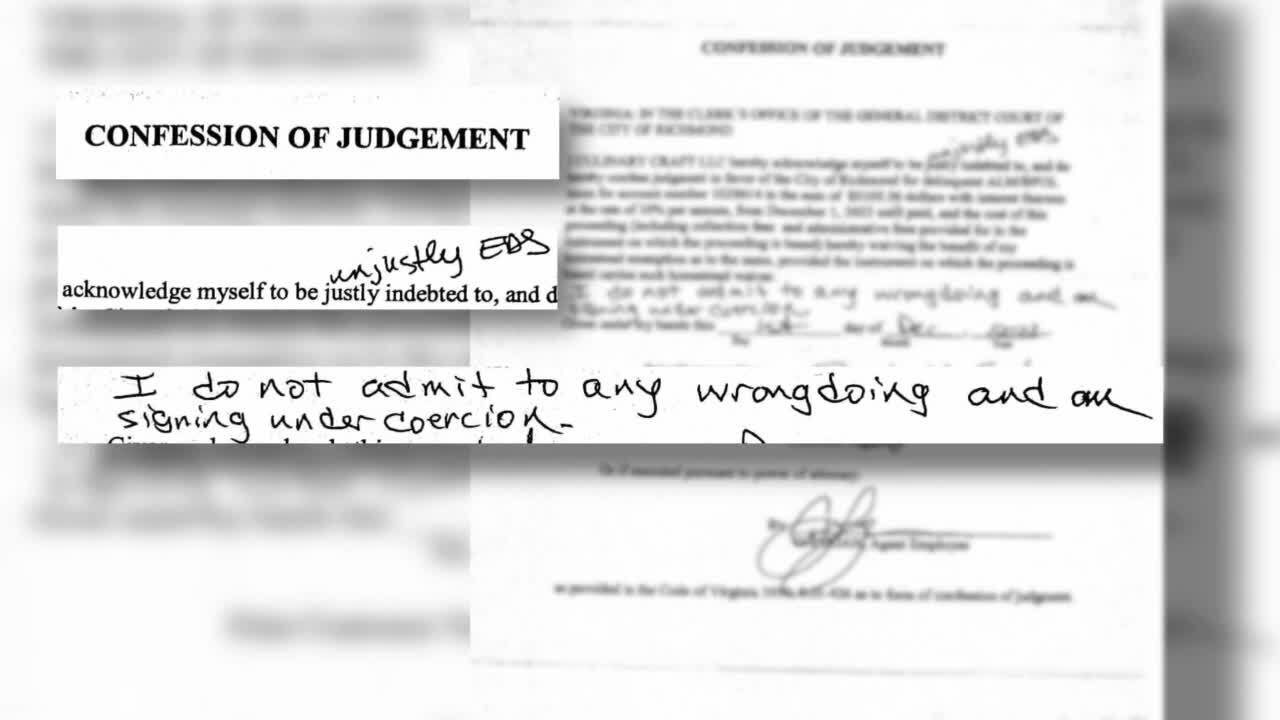

The document stated it was a Confession of Judgement "in the Clerk's Office of the General District Court of the City of Richmond."

By signing it, Sexton acknowledged she was "indebted to, and do hereby confess judgement in favor of the City of Richmond."

However, in her own handwriting, Sexton wrote on the form, "I do not admit to any wrongdoing and am signing under coercion."

“I cannot tell you how furious that made me because I still again didn't feel that I'd done anything wrong, and to sign a confession was a bit beyond the pale," Sexton said. "There was no explanation, and no documents were filed in court. This never went to court. This was all handled in the delinquent office at City Hall."

Virginia State Code states that such confessions "shall be entered of record by the clerk."

CBS 6 checked with the Clerk of Richmond's General District Court, Cecelia Garner, to ask if she had record of the confession.

Garner said she found "no case filed" under Sexton's name or business.

“Why did they give me a document that said “in the General District Court of Richmond?" I don't understand that. That cannot be right," Sexton said. "To act like a bully or treat us as if we're deliberately trying to rob the city is hurtful and unfair and so many things.”

Petula Burks, a spokesperson for the City of Richmond, said the city has used such forms for the past ten years as part of its collection process as a way to hold taxpayers accountable to payment plans. She said the documents are only filed in court when an account holder fails to comply with his or her payment plan.

"However, there are several intermediary steps that occur before taking someone to court, for instance, an account holder would receive a letter from the city alerting them to contact the city to get back on track with payments. If the account holder does not respond, the city reviews other options in the recovery process before turning the account over to a third-party collection agency. Finally, if all of those efforts are unsuccessful, the city would go to court to get a judgement. It is a long process," Burks said.

Burks said the city does not require any residents or business owners to sign documents forcefully.

She added the city's use of these forms is now under review as part of the city's improvement process.

Henrico County, another locality which collects a meals tax, said it does not use the confession of judgement process.

"We try to resolve issues with any business through communication. Henrico County will use the court process as a last result," said Henrico County Business Section Manager Elaine Hahn.

For Sexton, she'd like to get her $5,000+ back. The city indicated her account is under review.

"The city spoke with Ms. Sexton on January 25 and began the account and form review process shortly thereafter. The City will continue to communicate with her and to date has listened to her concerns. We value her feedback and have communicated to her that we are looking at the entire process," Burks said.

Depend on CBS 6 News and WTVR.com for in-depth coverage of this important local story. Anyone with more information can email newstips@wtvr.com to send a tip.