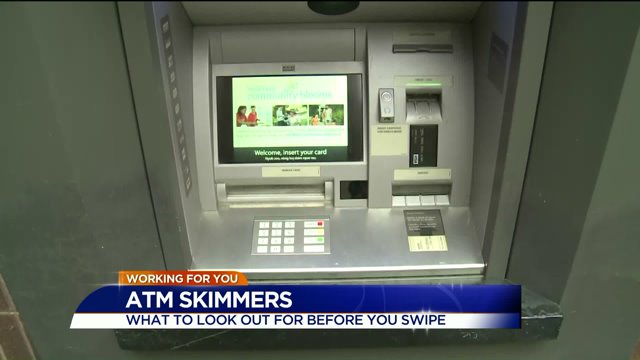

RICHMOND, Va. -- Virginia Credit Union became the latest banking institution to fall victim to ATM skimmers. Around 2,000 Virginia Credit Union debit cards are being replaced after the credit union discovered a scamming device on of one of its ATMs on Memorial Day. But what is an ATM skimmer and how can you avoid it?

Gregory Bell, a technology expert who runs Forensic Firm in Richmond, said skimmers are becoming more sophisticated and more readily available. They often are attached to functioning ATMs, in a way that molds are tightly overlapped onto card readers. Those molds are able to quickly scan the numbers on debit cards.

"You wouldn't realize it, but that skimmer is collecting that data," Bell said.

Bell said small cameras are often placed on the ATM to record PIN numbers. Sometimes fake pin pads are layered on top of the actual pin pad to record data. A thief has to go back to retrieve the skimmer, but once retrieved, they can clone the card or possibly access the account.

The typical ATM skimmer is a device smaller than a deck of cards that fits over the existing card reader. Most of the time, the attackers will also place a hidden camera somewhere in the vicinity with a view of the number pad in order to record personal-identification-numbers. The camera may be in the card reader, mounted at the top of the ATM, or even just to the side inside a plastic case holding brochures. Some criminals may install a fake PIN pad over the actual keyboard to capture the PIN directly, bypassing the need for a camera. --PCMag

Other majors banks have fallen victim to skimmers as well. Bank of America machines were reportedly hacked in Long Island, as well as Wells Fargo in Aspen and BB&T in Charlotte.

So how can you be on the lookout?

"If you see anything loose on the ATM that is usually a sign," Bell said.

Virginia Credit Union learned about the situation because they do routine checks on their ATMs to see if there is anything unusual on them. During a check on Memorial Day, they located the skimming devices.

Birch said he cannot say the exact date range the skimming devices were on the ATMs because the investigation is ongoing. He added that the bank is reaching out to all impacted customers and their cards are being replaced.

“If there is any loss due to fraud we will be restoring those members fully,” Birch said.