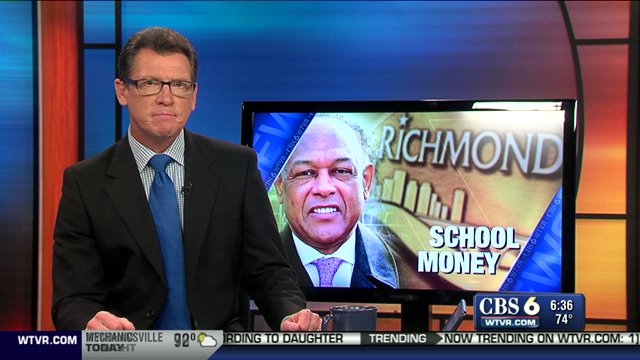

RICHMOND, Va. -- Richmond Mayor Dwight Jones said since city schools serve only about 11-percent of Richmond's population, it is important to look at the difference between what is important and what is urgent when it comes to spending money to improve them.

"When we make financial decisions about how to raise money and where to invest scarce dollars, we have to consider our whole population and we have to consider the needs for our entire city," Mayor Jones said while announcing his plan to lower Richmond's property tax by a penny in an effort to attract new people into the city.

He also announced the formation of a financial work group whose mission it is to come up with creative ways to pay for school improvements. The group is made up of the following corporate leaders:

- Matt Grossman CFO, Health & Beauty Group, MeadWestvaco

- Jeff Hemp CFO, Philip Morris USA & Director, Altria Client Services

- Scott Hetzer SVP & Treasurer, Dominion Resources Inc.

- Alma Showalter VP of Tax, Dominion Resources Inc.

"I am grateful to these companies for their willingness to lend us these valuable human resources," Mayor Jones said. "I’m asking that this group undertake an aggressive review schedule of financing options for schools needs, as I’m eager to chart a course of direction that will ultimately strengthen our school district."

The Richmond School Board has identified $35 million worth of repairs needed for city schools. At least one school board member questioned the mayor's decision to exclude school leaders from the group tasked with strengthening schools.

"I think it takes everyone at the table, not just the corporate entities to solve our problems in the city," Richmond School Board member Kim Gray said. "If we're only turning to the corporate side to solve problems, then we are going to continue to face the same issues over and over again."

Mayor Jones said he would like the financial work group to explore school financing options that include:

- The use of third-party financing models like public-private partnerships and that can fund repairs while producing renewable energy and energy efficiency projects; the savings from which can repay the private company.

- The possible use of tax-exempt private activity bonds for the construction of school facilities that could be leased back to the school system.

- A look at available tax credits that can be utilized, at the state and federal level and a look at what changes ought to be sought to jump start the use of available tax credits; including also the possible advocacy of an entirely new education tax credit.

- Available borrowing options and the implications for the city’s general revenue fund and/or real estate tax rate.

- Possible use of capital leases whereby a private company would finance and build a school and lease it back to RPS, who would ultimately own it at the end of the lease period.

The Mayor said he hoped the group's review would be complete when the School Board handed over its formal report of needs in November. He said his proposal was not a "jab" at Richmond Schools, rather, "the truth."

The Mayor's plan to lower Richmond's property tax rate must first be approved by Richmond City Council.